We strive to educate all families in order to help increase their financial understanding while providing solutions to protect and build their wealth. We have found that most people don’t understand how much risk they have in their investments—even their 401(k) plans—as well as the potential financial risks from medical disability or incapacity, higher income taxes, untimely death, or running out of income in retirement. We believe it’s best to plan ahead and hedge against as many risks as possible, using insurance strategies that offer multiple benefits.

Why Choose Tribute Wealth Management

Seeking the Swiss Army Knife of Financial Strategies

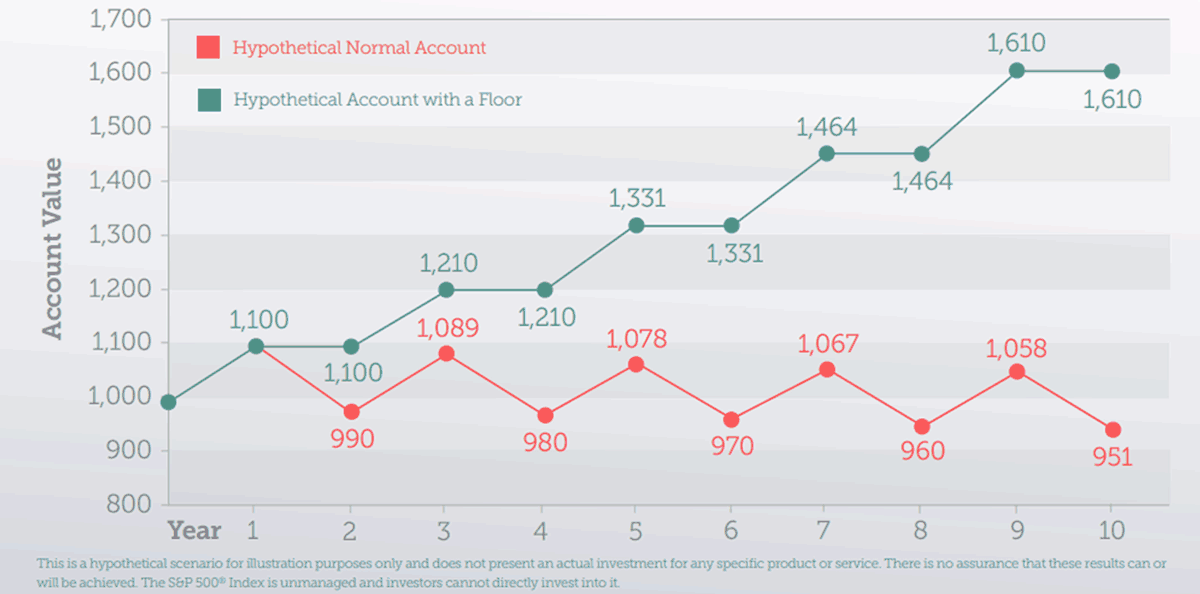

There are ways to take advantage of upside market potential while avoiding the danger of stock market drops. You don’t have to choose one or the other.

After you retire, in many cases you’ll have to draw money out of your 401(k) or a similar plan for income, hoping you don’t run out of money someday. We help you create a tax-advantaged lifetime income stream.

Reducing taxes goes a long way in protecting and increasing your wealth, although many people don’t realize that. We believe in finding solutions that also have tax advantages.

Insurance policies offer the chance to convey wealth tax-free to your chosen beneficiaries in most cases. (Beware new rules for traditional 401(k)s and IRAs—non-spousal heirs may owe a lot of tax unless you take action!)

Today’s hybrid life insurance policies offer long-term care benefits if you need them and a death benefit for heirs if you don’t. Long-term care finally has a solution that makes sense! There are also options which allow in-home care.

With college costs growing, consider insuring your toddler so they will have tax-free assets that they can use for any purpose, including college. Life insurance is not currently included by colleges in determining who qualifies for grants and scholarships.

Enjoy peace of mind knowing your assets are protected throughout your lifetime and beyond. Trust and estate planning can help ensure your loved ones are taken care of and your wishes are protected while minimizing taxes, avoiding probate, and preserving your financial legacy.

401k planning and employee benefits is a win-win for employees and employers. Make sure you are getting the most out of your benefits to lower taxes, retain talent, and meet your retirement goals.

Today’s Insurance Policies

Offering Multiple Benefits For Life

Today’s life insurance strategies are light-years ahead of what they used to be, and as interest rates increase, they are getting even better. Permanent insurance can usually be purchased at any age if you are healthy, and annuities can help you generate tax-advantaged retirement income for life. Tribute Wealth Management is independent and agnostic about your choices—our job is to do the research and explain how things work so that you can make your own decisions. We have access to hundreds of different types of life insurance products from more than 35 different insurance carriers.